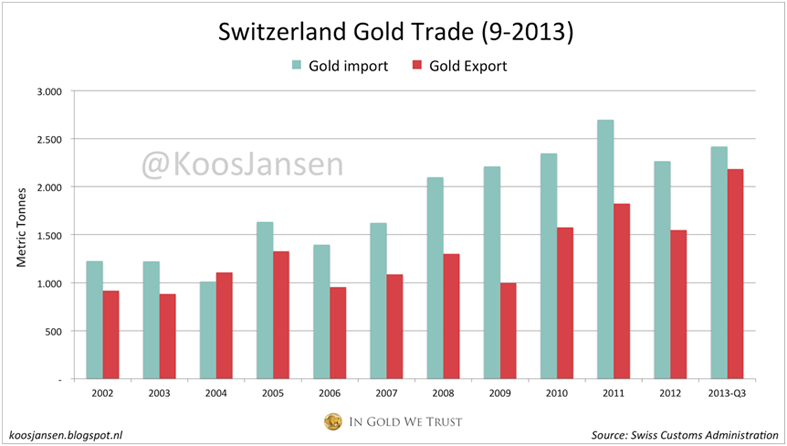

When I look at these two charts below from Koos Jansen (In Gold We Trust), I’m always amazed with the volume of gold being transferred from the West to the East, after a stop in Switzerland.

You can notice that almost all of the gold imported in Switzerland this year has been quickly exported toward China, via Hong Kong.

After having been transformed from 400-ounce bars with 99.95 purity (Western standard) to 1- kilogram bars with 99.99 purity (Asian standard), the gold is promptly exported from Switzerland to China. The volume of Swiss gold exports to Hong Kong was multiplied five-fold this year.

When one knows that the premiums on gold prices in India are rising because of import restrictions and that the demand for gold in China is still rising, one may wonder, how long will the gold price be determined by the West’s derivatives markets rather than by the physical markets of the East? Also, one must not forget that gold bought by individuals in Asia and by the world central banks is taken off the market for considerable periods of time (10-20 years), which diminishes the available volume for trading.

No comments:

Post a Comment