I have just spoken with Mr. Calles, at Banco Azteca. Mr. Calles purchases silver one-ounce “Libertad” coins for sale to the public through the offices of Banco Azteca, throughout Mexico, and thus he is in contact with the Mexican Mint.

Thursday, December 26, 2013

After a year, Bundesbank repatriates only 37 of 700 tonnes of gold

Only 37 tons?????? meanwhile China has scooped up a couple thousand tons!!!!!

While Germany's Bundesbank announced a year ago that it would repatriate most of the 700 tonnes of gold it has vaulted with foreign central banks, the Berlin newspaper Bild reported yesterday that only 37 tonnes have been repatriated so far:

BLOOMBERG: LONDON GOLD VAULTS ARE VIRTUALLY EMPTY, ALL THE GOLD HAS BEEN TRANSFERRED TO HONG KONG!

This is incredible. While discussing how the London vaults have been emptied and the gold has made it's way to china all they can think about is how the bull run in the price has ended.

Saturday, December 14, 2013

Swiss gold refiners have struggled to provide 40 tonnes of gold-a-week for China!

Secretive Swiss gold refiners have been working flat out all year to supply China with physical gold, at times struggling to find the gold supplies required to fulfill ballooning orders.According to this highly reputable source the Swiss are really scraping the bottom of the barrel now to find the gold to meet demand from China. In 37 years this refinery boss has never before experienced this problem. Some of the bars being refined are from the 1960s, from the back of the vaults.

Click Here To Read More At ArabianMoney.com

Click Here To Read More At ArabianMoney.com

Friday, December 6, 2013

Wednesday, December 4, 2013

Yuan Passes Euro as 2nd-Most Used Trade-Finance Currency!

China’s yuan overtook the euro to become the second-most used currency in global trade finance after the dollar this year, according to the Society for Worldwide Interbank Financial Telecommunication.

The currency had an 8.66 percent share of letters of credit and collections in October, compared with 6.64 percent for the euro, Swift said in a statement today. China, Hong Kong,Singapore, Germany and Australia were the top users of yuan in trade finance, according to the Belgium-based financial-messaging platform. The yuan had the fourth-largest share of global trade finance in January 2012 with 1.89 percent, while the euro’s was the second-biggest at 7.87 percent, Swift said.

The currency had an 8.66 percent share of letters of credit and collections in October, compared with 6.64 percent for the euro, Swift said in a statement today. China, Hong Kong,Singapore, Germany and Australia were the top users of yuan in trade finance, according to the Belgium-based financial-messaging platform. The yuan had the fourth-largest share of global trade finance in January 2012 with 1.89 percent, while the euro’s was the second-biggest at 7.87 percent, Swift said.

Tuesday, December 3, 2013

BREAKING: Canadian Maple Leaf Sales Q1-Q3 Already Surpass 2012 Total

As the Fed and Central Banks continue to pump huge amounts of liquidity into the market, investors have been buying record amounts of Canadian Silver Maples. Demand for the Canadian Gold & Silver Maples hit a record in 2011, but then declined in 2012 as investors started to believe that the monetary authorities had the financial system back under control — an illusion that will cost them dearly in the future.

After the huge take-down of the price of gold and silver during April of this year, demand for the Canadian Silver Maple Leaf bullion coins picked up to record levels. Not only were Silver Maple sales strong in the second quarter due to the extremely low price of silver, but demand was even greater during the third quarter… hitting a new all time record.

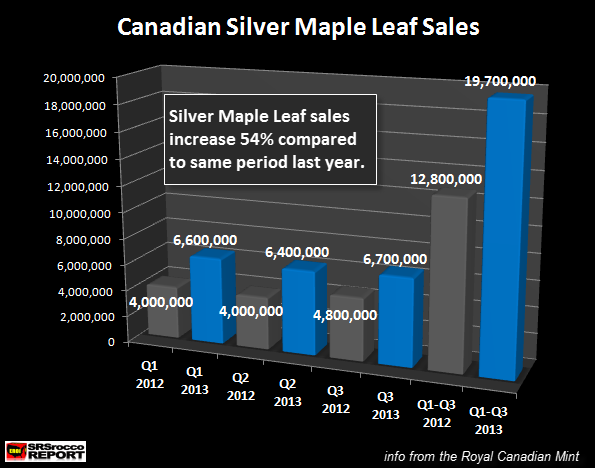

If we look at the chart below, we can see just how much sales of the Canadian Silver Maples have increased compared to the same period last year.

In the first nine months of 2012 total Silver Maple sales were only 12.8 million compared to the 19.7 million sold so far in 2013. This is a huge 54% increase y.o.y at nearly 7 million more Silver Maples sold.

Again, the third quarter sales of Silver Maples hit a record of 6.7 million compared to 4.8 million in the same period last year. This is the same phenomenon taking place with Silver Eagle sales. Sales of Silver Eagles increased in the third quarter at 11.0 million compared to 10.8 million in Q2 2013.

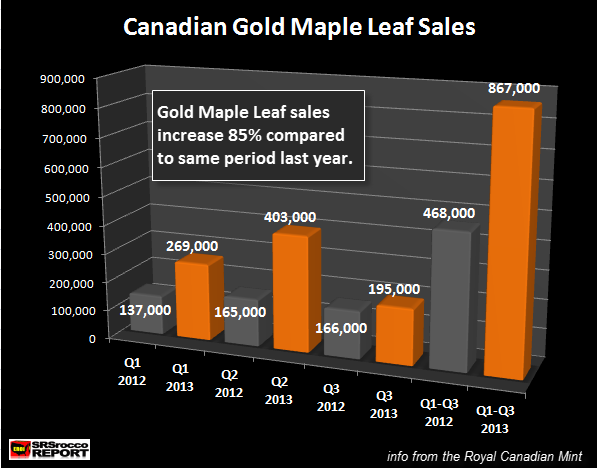

Furthermore, Gold Maple Leaf sales in the third quarter are still quite strong even though demand has dropped off compared to the previous quarter.

Sales of Gold Maples are up a staggering 85% in 2013 at 867,000 ounces compared to the first nine months in 2012 when only 468,000 were sold. Actually, Gold Maple sales are holding up much better than Gold Eagle sales.

Gold Maple vs Gold Eagle Sales (ounces)

Gold Maple Q1 = 269,000

Gold Maple Q2 = 403,000

Gold Maple Q3 = 195,000

Total Q1-Q3 = 867,000

Gold Eagle Q1 = 292,500

Gold Eagle Q2 = 336,000

Gold Eagle Q3 = 75,000

Total Q1-Q3 = 703,000

Here we can see that Canadian Gold Maples sold 195,000 oz during the third quarter compared to 75,000 oz of Gold Eagles. So, in the first nine months of 2013, Gold Maples have sold 23% more (164,000 oz) than Gold Eagles.

Gold & Silver Maples Sales Already Surpass 2012 Totals

Demand for the Gold & Silver Maple Leaf coins have been so strong in the first three-quarters of 2013 that they have already beat the total figures for 2012:

Total Silver Maple Leaf sales in the first nine months of 2013 were 19.7 million, surpassing the total 18.1 million for 2012. In addition, Gold Maple sales are already 12% higher at 867,000 oz compared to 772,000 oz for the total in 2012.

If this strong sales trend continues, we may see another ALL TIME RECORD in Silver Maple sales in 2013. In 2011, the Royal Canadian Mint sold 23.1 million Silver Maples which is only 3.4 million more than has been sold in the first three-quarters of 2013.

I would imagine we are going to see at least an additional 4.5-5 million Silver Maples sold in the last quarter which would bring the total for 2013 to be 24.5-25 million. I don’t believe Gold Maple sales in 2013 will surpass their record of 1,150.285 set in 2011. We would have to see more than 284,000 oz of Gold Maple sold in the remaining quarter of 2013 to beat this record.

This just goes to show how much more investors are buying Silver Maples & Eagles compared to their gold cousins… the Gold Maples & Eagles.

I believe silver will outperform gold in percentage terms as an investment and store of value in the next several years. As I have mentioned several times in prior articles, the Fed and monetary authorities can print money, but they cannot print Silver, Gold or Barrels of Oil.

As gold revalues much higher in the future, most of the public will only be able to purchase silver as its price will be more afordable. Thus, the demand for silver will be much greater than gold, pushing its value up to levels that the present disgruntled precious metal investors would believe impossible.

Sunday, December 1, 2013

October Chinese gold imports from HK massive 131 tonnes

Far from slowing down, net Chinese gold imports through Hong Kong accelerated in October to 131.2 tonnes according to figures sent to Reuters today - the seventh month this year that China has imported over 100 tonnes of gold and the sixth in a row.

Far from slowing down, net Chinese gold imports through Hong Kong accelerated in October to 131.2 tonnes according to figures sent to Reuters today - the seventh month this year that China has imported over 100 tonnes of gold and the sixth in a row. Click Here To Read More From MineWeb:

Subscribe to:

Posts (Atom)